Cash App card for kids offers parents a powerful tool to teach financial responsibility and prepare their teens for financial independence. This innovative feature allows parents to create supervised accounts for teenagers aged 13-17, fostering financial literacy while managing spending and promoting responsible money habits. This post delves into the features of Cash App cards, exploring their potential benefits and drawbacks, and guiding parents on setting up effective parental controls.

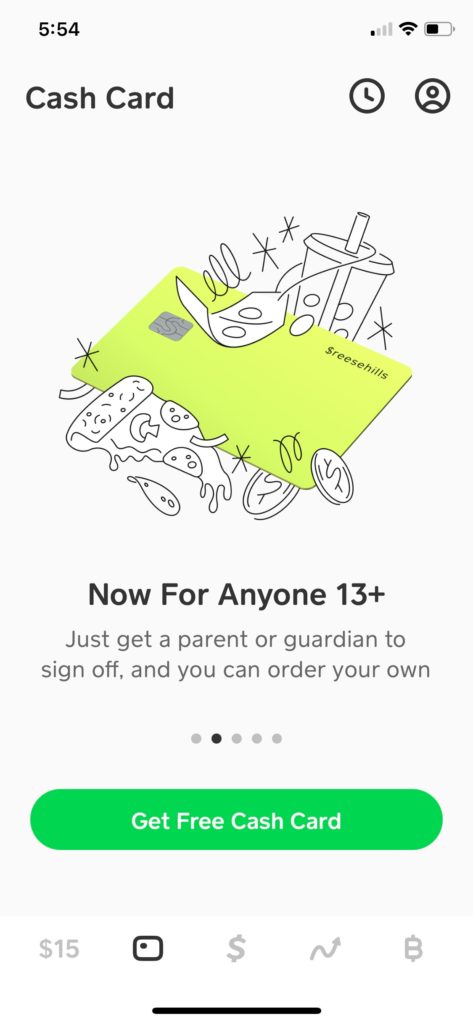

Previously, the Cash App was available only for users over the age of eighteen. But now Cash app is available to users over the age of 13.

What is Cash App card for kids?

Cash App is a popular mobile payment app that allows users to send and receive money quickly and easily. In 2021, Cash App opened up its platform to teens ages 13 to 17 with parental oversight. This means that parents can now create accounts for their teens and manage their spending.

Cash App offers a Cash Card, which is a Visa debit card that can be used to make purchases online and in stores. The Cash Card can be linked to a Cash App account, which makes it easy for kids to access their money.

There are a few benefits to using a Cash App Card for kids. First, it is a safe and convenient way for kids to make purchases. Second, it can help kids learn about money management. Third, it can help kids build their credit history.

However, there are risks associated with using a Cash App Card for kids. First, kids may be tempted to overspend. Second, kids may be more vulnerable to fraud and scams. Third, kids may not be able to understand all of the fees associated with using the card.

Additional tips

Here are some additional tips for parents who are considering getting a Cash App Card for their kids:

- Set spending limits: Parents can set spending limits on their kids’ Cash App accounts. This will help to prevent kids from overspending.

- Approve or deny transactions: Parents can approve or deny individual transactions before they are processed. This gives parents control over how their kids spend their money.

- Monitor activity: Parents can monitor their kids’ Cash App activity by reviewing their statements and transaction history. This will help parents to keep track of how their kids are using the app and to identify any potential problems.

By following these tips, parents can help to ensure that their kids use Cash App safely and responsibly.

How can I request approval for the Cash App?

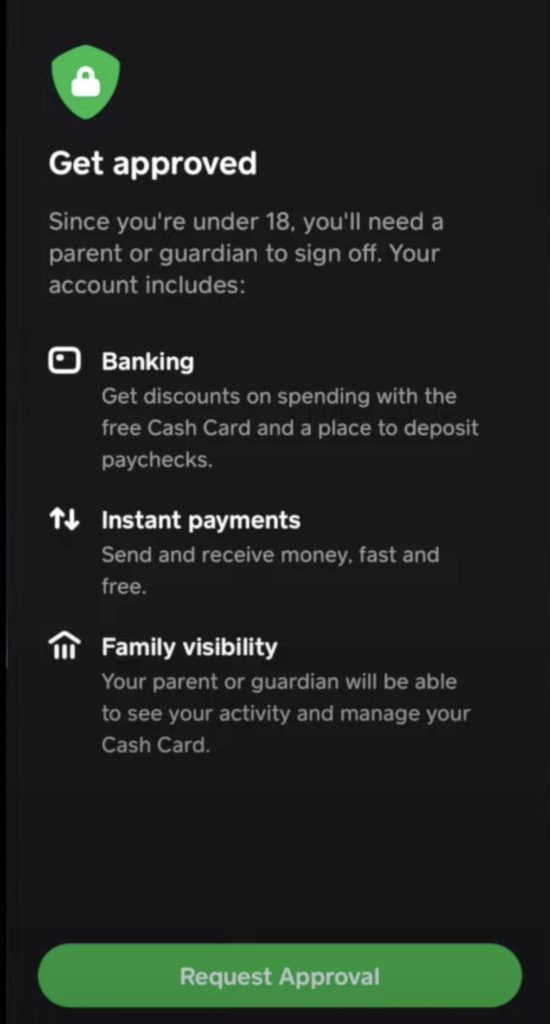

First, as a parent or guardian, you have to approve the Cash App card request sent from your kid. Teens aged between 13 and 18 can send a request for approval.

Once they get approval from you, they can use the app in the US for P2P transactions, Cash cards, direct deposits, and Boosts.

After you as a parent give permission, your son or daughter can become the legal owner and authorized user of their account. You can now have access to what they doing in the Cash App card and can track your kids’ card activity in monthly statements.

Can you get your kid a Cash App card at 13?

Yes, this card for kids works fine for anyone aged between 13 and 18.

How can I request the Cash App card for my kid and activate it?

Once your teen can get the Cash App downloaded on their smartphone, they can do the following steps to request approval for their card.

- Open the app and tap on the “Get Free Cash Card” button

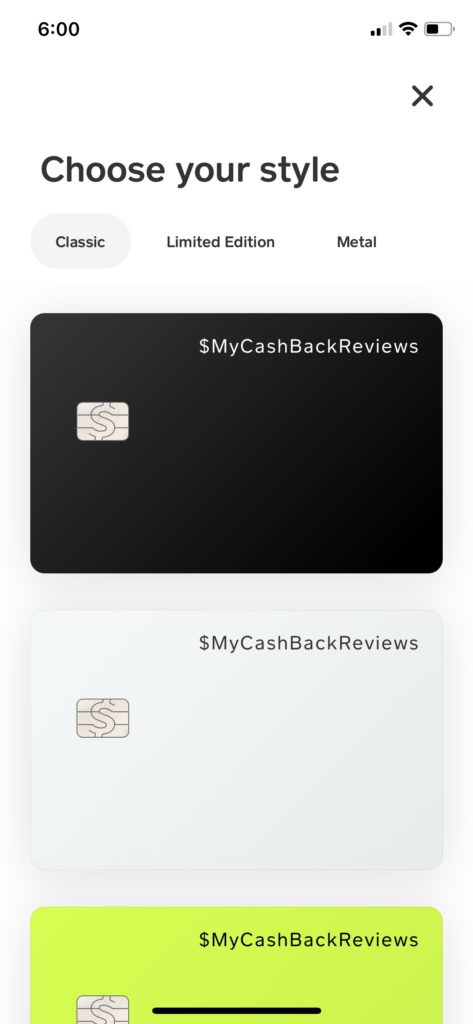

- On the next screen, they can select their favorite card design.

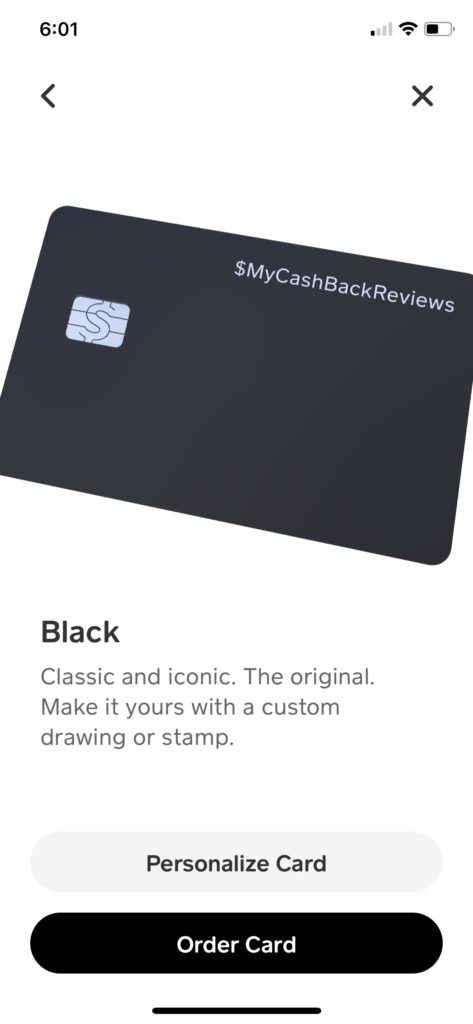

- After your kid selects a card design, on the next screen they can personalize their Cash App card with some custom icon, color, background, etc. They will then Tap on the Order card to order the card.

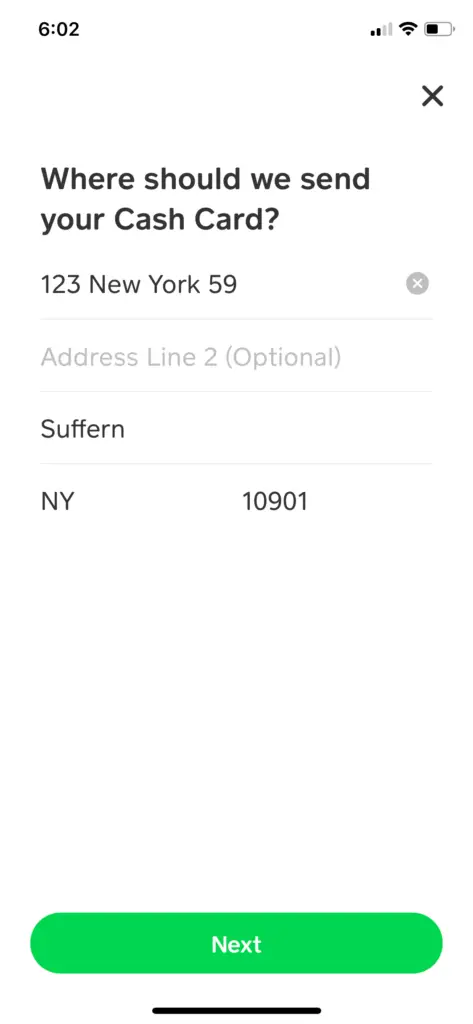

- On the next screen enter the address where you want the card to be sent.

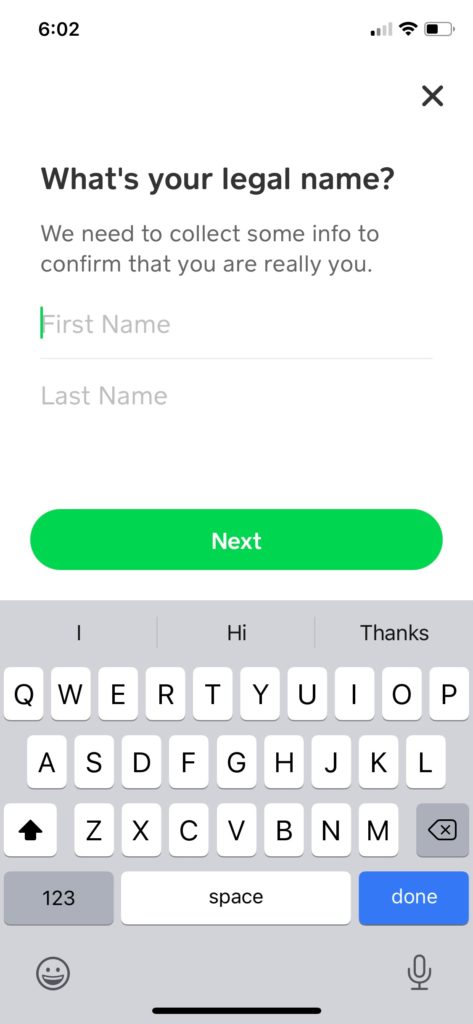

- Enter your name and date of birth on the next screen.

- You will see the screen where it says “Request Approval”. Tap on it.

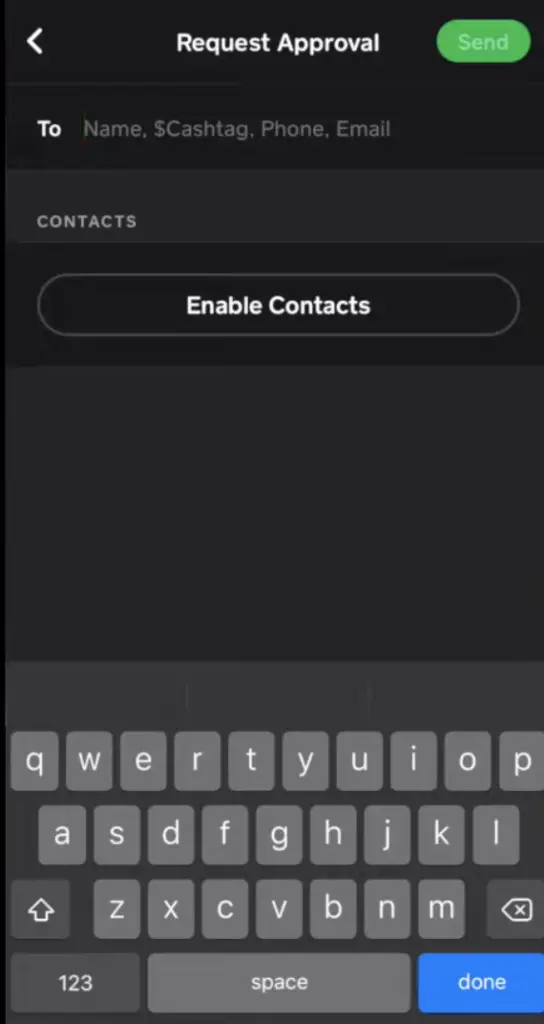

Enter your parents’ Cash tag, phone number, or email to send your request to them.

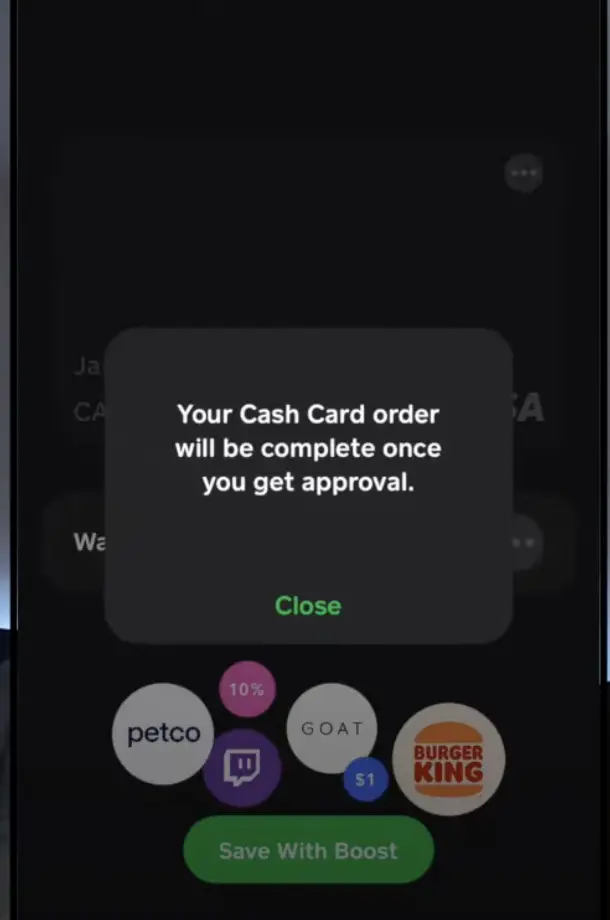

You will see a message that it is waiting for parents’ approval. Once approved, your kids’ Cash app card will be shipped to the address you entered in the previous step.

Pros and cons of using Cash App card for kids

Here are the pros and cons of using Cash App for kids:

Pros:

- A Safe and convenient way to make purchases: Cash App is a secure app that uses bank-level encryption to protect users’ funds. It is also a convenient way to make purchases, as it can be used anywhere with an internet connection.

- Can help kids learn about money management: Cash App can help kids learn about money management by giving them a way to track their spending and set spending limits. It can also help kids learn about budgeting and saving.

- Can help kids build their credit history: Cash App offers a feature called “Cash Card,” which is a Visa debit card that can be used to make purchases online and in stores. Using a Cash Card can help kids build their credit history, which can be helpful in the future when they apply for loans or credit cards.

Cons:

- Kids may be tempted to overspend: Cash App is an easy way to spend money, as it can be used to make purchases with just a few taps on a phone screen. This can lead to kids overspending, especially if they are not taught how to manage their money responsibly.

- Kids may be more susceptible to fraud and scams: Cash App is a popular target for fraud and scams. Kids may be more vulnerable to these scams, as they may not be as aware of the risks involved.

- Kids may not be able to understand all of the fees associated with using the app: Cash App charges fees for some of its services, such as instant deposits and ATM withdrawals. Kids may not be able to understand all of these fees, which can lead to them being overcharged.

Ultimately, the decision to allow your child to use Cash App is a personal one. Weigh the pros and cons carefully and decide what is best for your family.

here are the steps on how to set up parental controls on Cash App:

- Open the Cash App on your phone.

- Tap on profile icon in the top left corner of the screen.

- Tap on “Settings”.

- Tap on “Parental Controls”.

- Enter your PIN or Touch ID.

- Set spending limits, approve or deny transactions, and monitor activity.

How to set parental controls on Cash App

Here are some of the parental controls that you can set:

- Spending limits: You can set a daily, weekly, or monthly spending limit for your child.

- Approve or deny transactions: You can approve or deny individual transactions before they are processed.

- Monitor activity: You can monitor your child’s Cash App activity by reviewing their statements and transaction history.

It is important to note that parental controls are not foolproof. Kids can always find ways to get around them, so it is important to talk to your child about money management and the risks of fraud and scams.

Here are some tips for talking to your child about money management:

- Start by talking about the importance of saving money. Explain to your child that it is important to save money for the future, such as for college or a car.

- Help your child create a budget. This will help your child to track their spending and make sure that they are not overspending.

- Teach your child about the risks of fraud and scams. Explain to your child that there are people who will try to take their money and that they should be careful about whom they give their personal information.

By talking to your child about money management and the risks of fraud and scams, you can help them responsibly use Cash App.

Conclusion

In conclusion, the Cash App card for kids has all the features you can expect. It does not allow investing in stocks or Bitcoin.

If you or your kid lost your card, you can always request a new Cash App card for free. This post aimed to answer your questions about Cash App cards for kids.

Related posts: